You can be young without money, but you can’t be old without it.

Tennessee Williams

What Our Medical Field Clients Have To Say

Dr. James Horan on Life Insurance policies

Dr. Rosie and Dr. Rene Aviles on Life Insurance policies

Dr. Joseph Taub on Life Insurance policies

Other Professionals:

Gery Rodriguez on Life Insurance policies

Theresa Minnis on Life Insurance policies

“I have more than enough wealth to provide for my family after I’m gone. I don’t need life insurance.”

Significant wealth does not mean sufficient estate liquidity. Planning for enough cash to pay for estate expenses and creditors allows your designated executor the necessary time to deal with more difficult and illiquid assets like real estate. Life insurance is a simple strategy for a liquidity problem and can accomplish many other planning goals.

“My estate isn’t large enough to be subject to estate taxes. I don’t see the point in creating an estate plan.”

Professional estate plans are not just for the ultra-wealthy. Most people don’t realize the amount of work, time and money it takes to settle an estate. A basic plan, such as a Will coupled with life insurance, stream-lines the probate process and provides the liquidity necessary to settle an estate with a minimum amount of difficulty.

“I contribute the maximum to my retirement plan. What other options do I have?”

In many cases, the avenues for saving in tax-favored plans such as IRAs and 401(K)s are insufficient to meet projected needs, especially for business owners who can’t afford to fund robust qualified employer plans. Life Insurance can fill the gap and provide tax free benefits through retirement and for your family when they’ll need it the most.

“My blended family will eventually resolve any differences. There’s no need for special estate plan considerations”

Blended families present unique situations in estate planning. It can seem difficult for Individuals who have children from a previous marriage to be fair to all parties- including new spouse. Life insurance is a flexible, powerful tool to help couples balance out inheritances and fund any necessary trusts. It’s an easy way to provide immediate inheritance, especially if they may have to wait a years before eventually inheriting assets from a Trust.

A QTIP (Qualified Terminable Interest Property Trust) may be beneficial for blended marriages. These Trusts ensure that the estate assets pass to the surviving spouse, and then to the children without ending up in the hands of surviving spouse’s new husband or wife.

“It’s too late in my life for life insurance.”

Helping to make sure your spouse doesn’t struggle alone during retirement, makes life insurance valuable later in life too.

“I’m a stay-at-home parent. There’s no need for me to have life insurance.”

Even a parent who’s not the family breadwinner should consider life insurance. Replacing the care that a stay-at-home parent provides can be expensive, and life insurance can be a source of these funds if the unexpected happens.

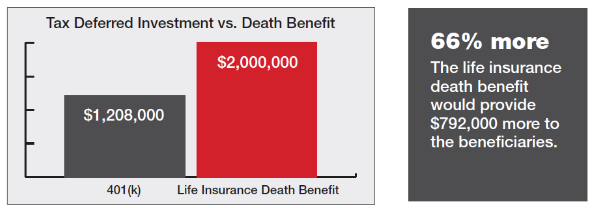

“Taxable vs. Tax Free”

To help illustrate how the value of having an income-tax free death benefit, look at the impact income taxes have on a 401(k) account valued at $2 million after it’s paid to a beneficiary who’s in the top tax bracket of 39.6%. The Beneficiary will have to pay taxes on the 401(k) account, which has a significant impact on its value. Compare that to what they would receive from an income-tax free life insurance death benefit of $2million.

Money is good for nothing unless you know the value of it by experience.

P.T. Barnum